Volatility is a measure of how much a stock or an index moves up or down in price over a certain period of time. It's a critical aspect of the stock market, as investors need to know how much risk they're taking on when they invest in a particular stock or index.

In the Indian stock market, the VIX (Volatility Index) is often cited as the standard measure of volatility. The VIX is also referred to as the "fear index" because it's supposed to measure the level of fear or anxiety in the market. It's calculated based on the implied volatility of Nifty options, which are contracts that give the holder the right to buy or sell the Nifty index at a predetermined price within a specified time frame.

However, when we look at the Nifty market, it's clear that the VIX doesn't always behave in the way we would expect. For example, there have been instances when the market has fallen sharply, but the VIX hasn't risen as much as we might expect. This has led some investors to question whether the VIX is really an accurate measure of volatility in the Nifty market.

An alternative measure of gauge volatility could be Nifty GEX (Gamma Exposure). This index is calculated based on the gamma exposure of Nifty options, which is a measure of how much the price of an option will change for a given change in the price of the underlying asset. Essentially, the Nifty GEX measures how much the options market is exposed to changes in the Nifty index.

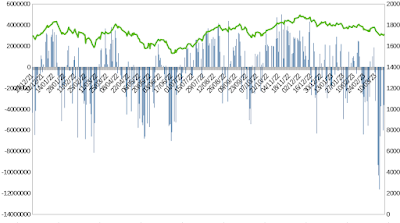

What's interesting is that the Nifty GEX can be seen from chart below to be a more reliable indicator of volatility in the Nifty market than the VIX. In fact, the Nifty GEX has always mirrored the volatility of the Nifty index perfectly, which is not always the case with the VIX.

So, the question arises, should investors be looking at Nifty VIX or

Nifty GEX for a more accurate measure of volatility in the Indian market?

While the VIX is still a useful measure of volatility, the Nifty GEX is

a more accurate measure of how much the market is likely to move in the

near term. This is because the Nifty GEX is based on the actual

positions taken by options traders, while the VIX is based on their

expectations.In conclusion, So, when it comes to assessing the level of volatility in the Nifty

market, it may be more accurate to rely on the Nifty GEX rather than the

VIX. However, it is important to keep in mind that both indicators are

just that - indicators. They are not foolproof measures of volatility

and should be used in conjunction with other fundamental and technical

analysis tools to make informed investment decisions.

Read more on

Nifty GEX at What is GEX (Gamma Exposure)? .

Historically how Nifty GEX has moved at Historical Nifty GEX