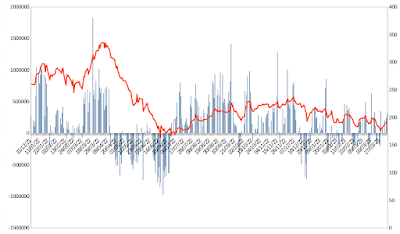

Below

is the historical chart of Kotak Mahindra Bank GEX for the period from January 19,

2022, to April 27, 2023. Gamma exposure, which measures liquidity and

volatility, closed flat on April 27th with a closing value of 3L,

after being at 3L on April 26th.

GEX was flat despite a rise in share price which closed with 1.5% on April 27th. Again this could be attributed to monthly expiry.

Additionally, GEX has exhibited volatile behavior over the past 200

days, with an average value of 2L and a median value of 2L. The value

range has been wide, ranging from a low of -6L to a high of 10L.

Nifty GEX at What is GEX (Gamma Exposure)? .

Historically how Nifty GEX has moved at Historical Nifty GEX

Other links:

Other methodologies for calculation of GEX How to Calculate Gamma Exposure (GEX) and Zero Gamma Level